Governance

The Sovereign Fund of Egypt is structured with a rigorous governance framework that ensures TSFE processes and procedures are in accordance with industry best practices and follow transparent decision-making processes.

TSFE is supported by leading experts on both the General Assembly and the Board of Directors levels.

TSFE’s governance strategy relies on a key set of standards adopted to ensure a reliable and consistent support framework.

Auditing of Accounts

The auditing of the accounts of the fund is undertaken by two auditors, one of whom is an independent/private sector auditor as chosen by the General Assembly and the other the Central Audit Bureau (Accountability State Authority).

IFSWF Membership

TSFE is a member of the International Forum of Sovereign Wealth Funds (IFSWF), which aims to promote transparency, good governance, accountability, and sustainable investment practices.

Santiago Principles

TSFE adheres to the Santiago Principles, which consists of 24 generally accepted principles and practices voluntarily endorsed by the IFSWF.

Responsible Investing

Responsible investing is a cornerstone of TSFE’s investment strategy and part of its commitment to sustainable value creation from assets in Egypt and beyond. TSFE follows the Environmental, Social and Governance (ESG) framework for responsible investing, and is a member of the One Planet Sovereign Wealth Funds (OPSWF).

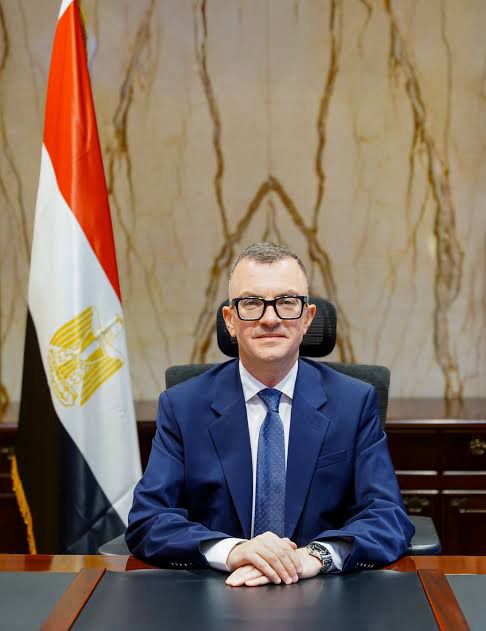

Leadership

Mandate: Monitor overall TSFE & Board performance

Members: Formulated by presidential decree No. 538 of 2023 comprised of the Prime Minister (Chair), Minister of Planning & Economic Development, Minister of Finance, Minister of Investment, Deputy Governor of the CBE; 7 independent members who are experts in the financial, economic, and legal fields and in management of similar funds.

Mandate: Approve overall Fund strategy, key guidelines & investment decisions

Members: Formulated by presidential decree No. 382 of 2023, comprised of Minister of Planning & Economic Development (Chair), representative of Ministry of Finance, representative of Ministry of Investment; 5 independent members who are experts in the financial, economic and legal fields and in management of similar funds

The board of directors has formulated 4 internal committees, namely:

- Investment committee

- Remuneration committee

- Governance & Internal Audit committee

- Risk and Compliance committee